The EU-Mercosur free trade agreement is more than a historic trade pact; it’s a strategic maneuver poised to fundamentally alter the geography of the global battery and electric vehicle (EV) industry. For stakeholders across the lithium-ion battery value chain—from miners and processors to cell manufacturers and OEMs—understanding this shift is no longer optional. It’s critical for future-proofing your strategy.

Part 1: The Core of the Deal – Securing the Critical Mineral Lifeline

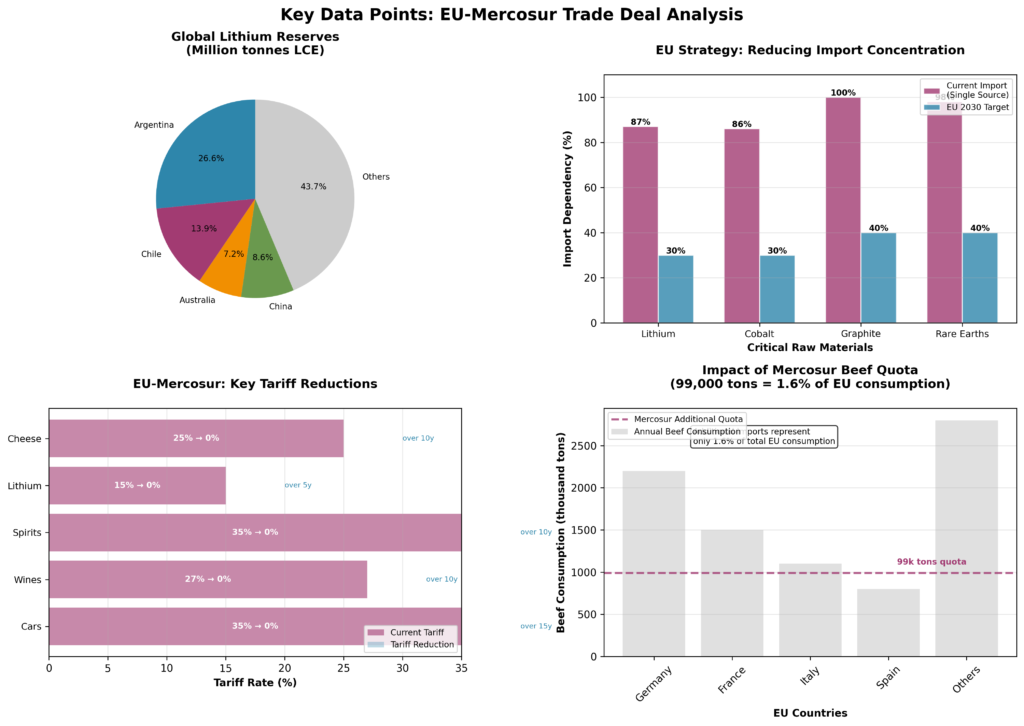

At its heart, the agreement is a direct response to Europe’s urgent need for supply chain resilience and strategic autonomy. The pact explicitly aims to reduce over-reliance on single sources, particularly for the critical raw materials powering the green transition.

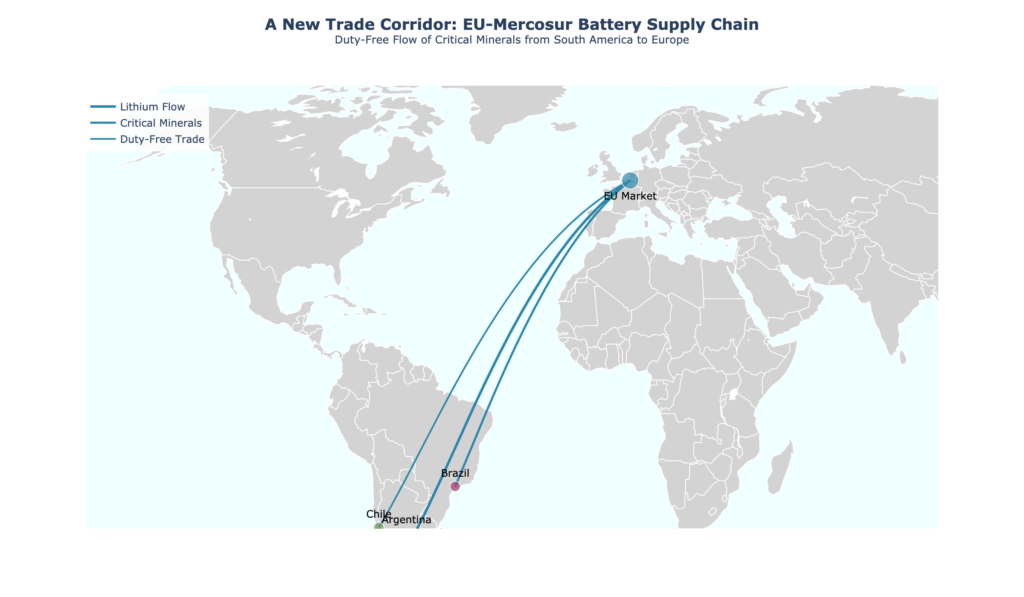

The most direct and powerful mechanism is the elimination of export duties on critical minerals. For battery metals like lithium—where the “Lithium Triangle” of Argentina, Chile, and Brazil holds over half of the world’s reserves—this means a significant reduction in the cost of shipping raw and processed materials to European shores. This isn’t just about tariffs; it’s about de-risking and incentivizing a massive reorientation of material flows.

Part 2: The Ripple Effects: Reshaping the Competitive Landscape

The implications cascade through every layer of the battery value chain, creating both immediate opportunities and long-term strategic shifts.

1. Upstream (Mining & Primary Processing): A New Investment Frontier

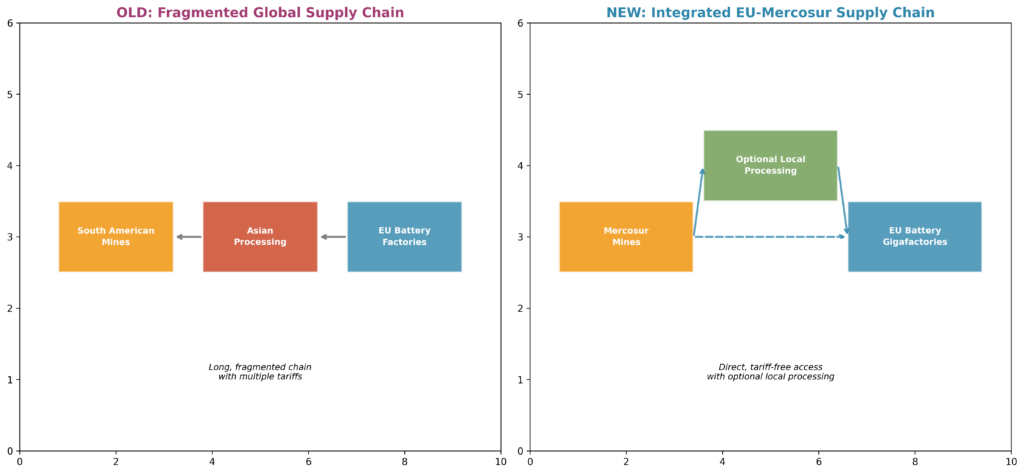

The deal sends a clear market signal to mining investors: projects in Mercosur countries that align with future EU standards will have a guaranteed, preferential access route to one of the world’s largest EV markets. We can expect a surge in joint ventures and strategic partnerships between European industrial players and South American miners. The goal will evolve from merely exporting raw spodumene to establishing more localized lithium hydroxide and carbonate conversion capacity near the mines.

2. Midstream (Materials & Cell Manufacturing): A Dual Challenge for Incumbents

For established battery material producers and cell manufacturers, particularly in Asia, the landscape is changing.

- For European Manufacturers: They gain a more secure and cost-predictable feedstock, strengthening the business case for gigafactories in the EU. The “local-for-local” supply chain model gains credibility.

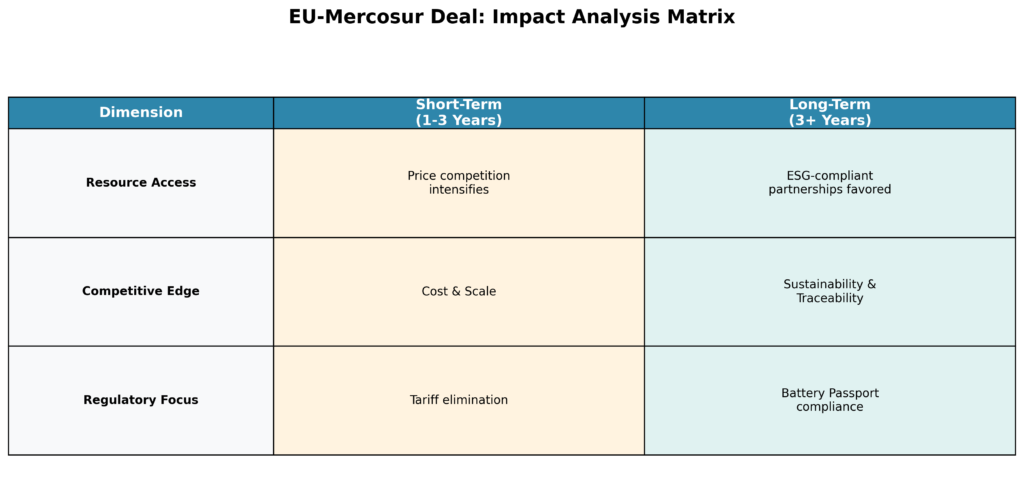

- For Global Competitors: The playing field tilts. While cost competitiveness remains, future access to the EU market may become contingent on meeting stringent, non-tariff barriers related to the carbon footprint and ethical sourcing of their raw materials. The deal accelerates the shift from competition purely on price to competition on sustainability credentials.

3. The New Rules: Sustainability as a Trade Barrier

This is arguably the most profound long-term impact. The agreement is laced with environmental and labor commitments, including fighting deforestation. While critics question enforceability, the direction is clear: the EU is exporting its regulatory framework.

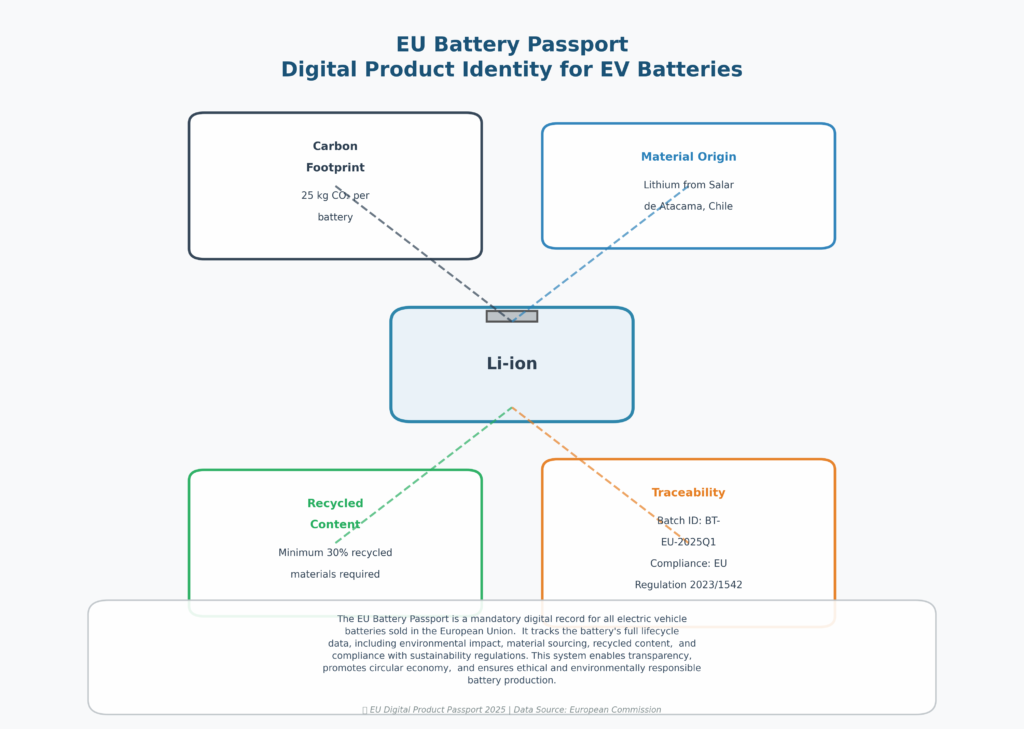

The EU Battery Regulation and its upcoming “Battery Passport” will require full transparency on the carbon footprint, material provenance, and recyclability of every battery sold in Europe. By securing raw materials from a partner bloc with aligned (or aligning) sustainability commitments, the EU is building a “green supply chain club.” Materials from outside this club may face de facto barriers, regardless of formal tariffs.

Part 3: Strategic Considerations for Industry Leaders

In this new paradigm, waiting is not a strategy. Proactive players should:

- Diversify with Purpose: Sourcing strategies must now evaluate not just cost and quality, but ESG compliance and geopolitical alignment. Mercosur assets have just become strategically more attractive.

- Think in Partnerships: Vertical integration may be impractical for many. The new model will be strategic long-term offtake agreements and equity partnerships with miners and processors in favored jurisdictions.

- Invest in Traceability: Robust, blockchain-supported systems to track the carbon footprint and provenance of raw materials are no longer a CSR project; they are a core compliance and competitiveness tool.

- Stay Ahead on Technology: Ultimately, the most powerful way to navigate resource geopolitics is to reduce dependency. Accelerating R&D in next-generation technologies (e.g., solid-state, sodium-ion) and superior recycling ecosystems provides the ultimate strategic hedge.

Conclusion: Navigating the New Map

The EU-Mercosur deal marks a pivotal moment. It moves the world from a era of hyper-globalized, efficiency-driven supply chains to one where resilience, sustainability, and strategic alignment are the primary currencies.

The map of the global battery industry is being redrawn. The question for every company in the space is no longer if they will be affected, but where they will position themselves on this new map. The winners will be those who see this not just as a trade deal, but as the blueprint for the industry’s next chapter.

Is your supply chain strategy prepared for this new reality? The time to reassess, partner, and adapt is now.

Disclaimer & Source: This analysis is based on the provisional EU-Mercosur agreement as reported by Reuters and other financial outlets. It is intended for strategic insight and does not constitute investment or legal advice.

中.jpeg)